PSTom

Member

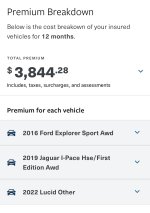

Our auto insurance is up for annual renewal in April, which brought up the question of insurance costs for the Lucid Air. Our agent explained that vehicle insurance is based completely on the safety rating of said vehicle. But I can’t find any rating info for Lucid Air. Even Consumer Reports says the Air is unrated. Any thoughts about this or alternative info you may have been given?