40% increase for my 2013 Mazda and 50% increase for my Lucid. What the heck!? Anyone else got massive insurance increase?

From Wawanesa.

"The cost of providing insurance coverage has increased significantly since we last increased rates for all our customers in

2018. This is due to a variety of factors:

- Serious injuries resulting from accidents have increased 12%, impacted by increased speeds

- The cost to repair vehicles (including parts & labor) has increased 40%

- The cost of replacing used vehicles when totaled has increased 60%

- The cost of medical claims has increased 55%"

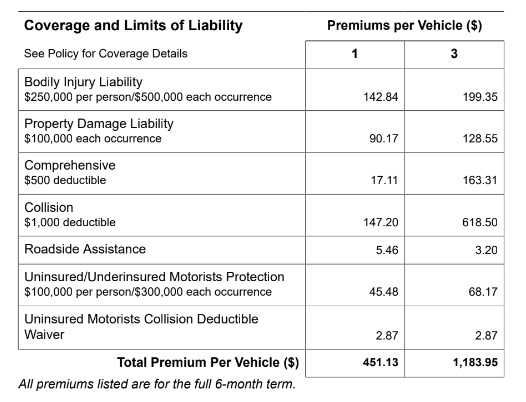

What I have now

Next month

From Wawanesa.

"The cost of providing insurance coverage has increased significantly since we last increased rates for all our customers in

2018. This is due to a variety of factors:

- Serious injuries resulting from accidents have increased 12%, impacted by increased speeds

- The cost to repair vehicles (including parts & labor) has increased 40%

- The cost of replacing used vehicles when totaled has increased 60%

- The cost of medical claims has increased 55%"

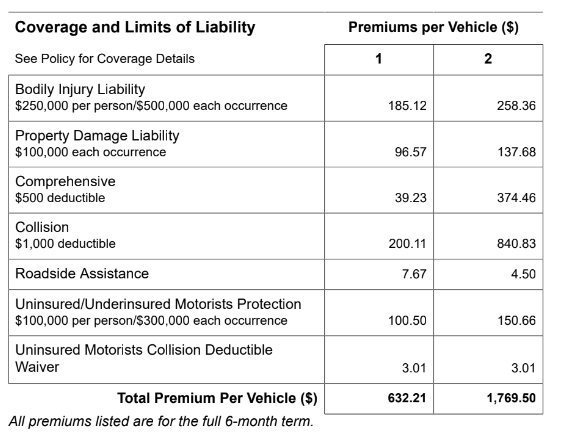

What I have now

Next month