Good luck with that part. I'd put my recently returned (20 months) 2023 lease up against anyone's... perfect inside and out, i even had the floormats in untouched/never used condition in a bag since I was afraid of getting them dirty (santa cruz white color). Not a single door ding, windshield chip, or curb rash. Lucid employee walked around it and said it looked perfect inside and out, but his judgement was irrelevant, it was up to their 3rd party inspectors. That (and these forums) convinced me to document every inch of the car with video AT the lucid studio drop off, showing date/time, lucid studio, and walk around of the car.

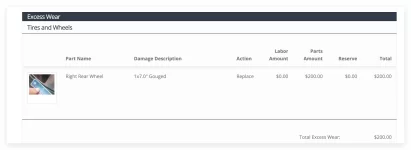

FULLY expected zero charges. Well, they found this tiny blemish on one wheel and have now assessed me $200 and marked it as "replacement" for the wheel. They also called it a 1" x 7" gouge... when the photo clearly shows it's a 1.5" scuff. That's the only damage they found or charged me for.

You be the judge. (their photo, not mine)

View attachment 30489

View attachment 30490

That was all they could find, but apparently that "gouge" as they call it necessitates a completely new replacement wheel?

If I bought a USED Air Touring and it was pristine in every way except that tiny scuff on one wheel after 20 months and 9100 miles, I'd have said I found a gem.

Lucid's 3rd party inspectors must be paid bonuses to find things like this to disallow the entire wheel and charge an "excess wear" charge. After leasing proably 10 vehicles, I've never had an experience like this... turned in nice cars with a few door dings, bumper scuffs, and actual wheel curb rash and those other companies assessed nothing for "expected" minor things like that. Not so Lucid.

Will be eager to hear how it goes for you, maybe my inspector was having a very bad day.

Terrible turn-in experience. Yeah, it's just $200, but given the pristine state of my car, if this is all they can find after looking with magnifying glass everywhere, then you'd think they'd let it go, especially on the day i was leasing the NEXT $100K Lucid. Petty!