- Joined

- Feb 23, 2022

- Messages

- 1,827

- Reaction score

- 1,340

- Location

- Salt Lake City Utah

- Cars

- Lucid Air Grand Touring

- Referral Code

- RVGCLMKM

I see this often where people constantly compare LCID to TSLA, although they are competing in the EV space, I don't think anyone should expect LCID to do as well as TSLA stock, and the reason I say that is because the value TSLA has is on way more than just its vehicles. TSLA has established itself as energy, battery tech, solar, public transport and robo taxis, robotics and AI, etc... which investors believe in the future potential of TSLA to do a whole bunch of different things other than its electric vehicles.

Where as LCID is definitely more about the vehicles and the tech, supplies, battery, and parts around the EV space.

TSLA was always super low in price until mid to end of 2019, which is right about when the Model Y came out, and a few years after the model 3. That's when the stock took off. Similar to how LCID is small in value right now before any cheaper mass produced vehicle. Even if LCID takes off after Gravity and the cheaper model is mass produced, its ceiling may be far lower as LCID is more specific to what it wants to do versus open ended as TSLA delving into other random industries.

Correct me if I'm wrong, but I wanted to throw it out there as I do always see comparisons.

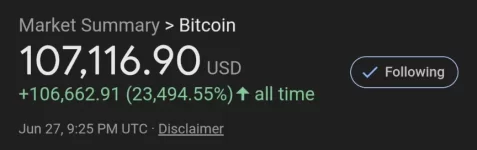

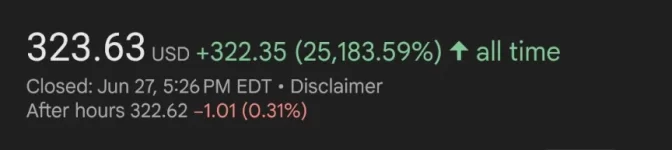

One fascinating thing I did notice is that if you look at the % increase from beginning to end, BTC and TSLA are very close in %, about 23,000%. Actually BTC should be higher because MAX only shows from 2016. But anyways, thought that was interesting.

Where as LCID is definitely more about the vehicles and the tech, supplies, battery, and parts around the EV space.

TSLA was always super low in price until mid to end of 2019, which is right about when the Model Y came out, and a few years after the model 3. That's when the stock took off. Similar to how LCID is small in value right now before any cheaper mass produced vehicle. Even if LCID takes off after Gravity and the cheaper model is mass produced, its ceiling may be far lower as LCID is more specific to what it wants to do versus open ended as TSLA delving into other random industries.

Correct me if I'm wrong, but I wanted to throw it out there as I do always see comparisons.

One fascinating thing I did notice is that if you look at the % increase from beginning to end, BTC and TSLA are very close in %, about 23,000%. Actually BTC should be higher because MAX only shows from 2016. But anyways, thought that was interesting.