- Joined

- Jun 5, 2022

- Messages

- 10

- Reaction score

- 10

- Cars

- Lucid (ordered): Audi Etr

I just spoke Lucid Financial Services today as I'm considering all of my options.

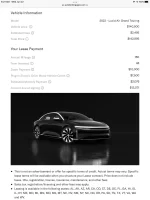

Leases will be offered from 24 months up to 48 months. It depends which state you live in whether you can buyout the lease for the residual at the end of the term. I live in Florida so I could lease for whatever term and then buy the car for the residual if I choose. Obviously, there are many factors that will determine the monthly lease payment which can only be determined during the application process. There is an early termination penalty.

As far as financing (loan), it will range from 48 months to 72 months. There is no prepayment penalty. Rates depend on the time the loan is secured.

Hope this information is useful.

Leases will be offered from 24 months up to 48 months. It depends which state you live in whether you can buyout the lease for the residual at the end of the term. I live in Florida so I could lease for whatever term and then buy the car for the residual if I choose. Obviously, there are many factors that will determine the monthly lease payment which can only be determined during the application process. There is an early termination penalty.

As far as financing (loan), it will range from 48 months to 72 months. There is no prepayment penalty. Rates depend on the time the loan is secured.

Hope this information is useful.