Abuse. Referral programs are ripe for abuse, and have been abused since they’ve existed (buying AdWords, etc). I know because… well, let’s just say that once upon a time I had roughly infinite AWS credit and while I have a lot of friends, I don’t have a >$1M credit number of friends lol.

That said, I’m not *at all* saying

@thecodingart was abusing it - but that would be a reasonable reason to limit it.

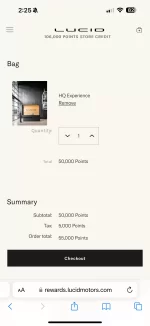

And in case you’re thinking “but it sells cars!”… that’s true, but when the referral bonuses are things that can be resold (EVSE, etc), Lucid would be losing money on those if that happened.