Hi XXXXX,

We've received quite a few inquiries from the Rivian community asking how the Inflation Reduction Act (IRA) may impact your eligibility to obtain the $7,500 IRC 30D federal EV tax credit when you purchase your R1T or R1S. Here's what we know and how we plan to support our customers’ efforts to maintain eligibility for the federal EV tax credit.

The Inflation Reduction Act may soon become law.

Once signed into law, the Inflation Reduction Act will add new restrictions to buyers’ eligibility to receive the $7,500 IRC 30D federal EV tax credit. Under these new restrictions, an electric pick-up truck or SUV must be priced below $80,000 and the buyer must fall below certain income thresholds to qualify.

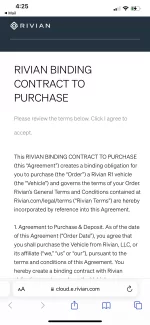

Fortunately, buyers who have a “written binding contract” to purchase a qualified EV before the Inflation Reduction Act becomes law will be able to apply under the current IRC 30D tax credit requirements.

What Rivian preorder and reservation holders can do.

If you’d like to sign a binding contract for your R1T or R1S purchase, click “Review and Accept” below. Signing the contract will make $100 of your existing $1,000 deposit non-refundable and help you to maintain eligibility to apply for the $7,500 tax credit under its current requirements. According to the Senate bill, any customer with a binding contract will not be subject to the new vehicle price and income restrictions when applying for the federal tax credit, regardless of the vehicle delivery date. We do want to caution that the final bill terms are not certain and have not yet been passed by the House of Representatives. Further, we cannot guarantee that the IRS will approve tax credit eligibility as we interpret the terms of the Inflation Reduction Act. However, we are offering our customers this opportunity as a way to do what we can to increase the probability of receiving the $7,500 IRC 30D tax credit.

When will the Inflation Reduction Act be enacted?

While we can’t predict exact timing nor guarantee it becomes law, this bill has already passed the Senate and will head to the House for a vote on Friday, August 12. All indications are that this legislation should pass the House and then be signed into law. Once signed, the Inflation Reduction Act is considered enacted.

Rivian customers interested in signing a binding contract may do so by clicking the button below and agreeing to the terms. Once the Inflation Reduction Act becomes law, customers will lose this chance and be subject to the new restrictions on vehicle price limits and personal income caps.

What happens if I decide to do nothing?

Taking this step is your choice. If you decide not to sign the binding order agreement, your Rivian deposit will remain under our existing fully refundable terms.