With your background, how do you reconcile the "5% of contract value" as an example of what is a written binding contract on the IRS website? Having attempted to read it, I know that's not the actual language in the bill, but does the IRS usually have discretion in instances like this to impose such a restriction?

Sorry I'm just seeing this question. I was offline most of yesterday finishing up Christmas shopping. Before I answer, understand I'm not a tax advisor, or tax attorney, and this is not financial advice.

I reconcile the 5% in two ways. First, on the IRS website they state non-refundable deposit OR 5%. That's number one.

Second, in the actual language of the Transitional Rule in the Bill that is now Law, there's no mention of a date that the car MUST be placed in service. The law's language to me and a few others is clear. It states, "after December 31, 2021, and before the date of enactment of this Act, a taxpayer that purchased or entered into a written and binding contract to purchase a new qualified plug-in electric drive motor vehicle as in effect on the day before the date of enactment of this act, and placed such vehicle in service on or after the date of enactment of this Act, such taxpayer may elect to to treat such vehicle as having been placed in service on the day before the date of enactment of this act."

So now the question that the IRS turned into this mess is what's a binding contract and their poor explanation of a binding contract. This is where the interpretations are all over the place. Some are saying a binding contract had to have a minimum of 5% as your deposit. This is inaccurate in my opinion. The IRS gives this 5% as one example but also gives another example -- a non-refundable deposit in the same sentence with the use of the word OR.

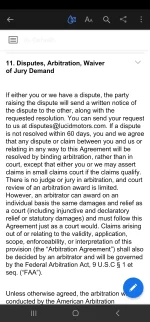

Next the IRS states "a written contract is binding if it is enforceable under State law and does not limit damages to a specified amount.... by the use of a Liquidated Damages provision or the forfeiture of a deposit." This is likely the reason Lucid and other folks here are saying cars not delivered in 2022 won't qualify. This interpretation is wrong in my opinion. First, BOTH parties to a contract have remedies. Lucid stated in our order agreements that they are electing to keep our $1,000 deposit as liquidated damages if we, the customer breaches. Okay fine. However, ask yourself, what's the customer's remedy if Lucid breaches? The answer to the question is found in Section 11 (Disputes, Arbitration, Waiver of Jury Demand) in our order agreements. Since this is the remedy agreed to by Lucid and the customer for a customer's claims and disputes with Lucid, the IRS' liquidated damages language doesn't apply as a limiter to our contracts being binding. If the contract language said something like both Lucid and the customer agree to a set amount as liquidated damages, then Yes, our contacts likely would be considered non-binding

Second, the interpretation that cars must be delivered in by the end of 2022 to qualify for the tax credit doesn't even take into consideration the Transition Rule for written and binding contracts PRIOR to the passage of the IRA. The IRS lists two scenarios -- contracts prior to August 16, 2022 and those contracts between August 16, 2022 and December 31, 2022. I discuss these in an earlier post a few pages back. My reading is that IRA rules don't apply because we fall under the old rules that were in effect prior to the passage of the IRA.

To answer your final question, the IRS is a government agency. They operate under our tax laws first and have established regulations that must conform to the law. In essence, the IRS cannot write a regulation that is not consistent with tax laws. Since I am not competent in tax code or IRS' regulations, can't answer this question definitively.