Curious to see if my situation is typical. I'm sharing a lot of detail (maybe too much?), but history and coverage differences can have a huge impact.

2023 Lucid Air Pure AWD - MSRP of $96.6k, but paid $75.2k + tax & fees. (Was told that my insurer (Acuity) insisted on insuring at MSRP instead of the price paid, whatever that means. My guess is the 'if totaled' value would be about half the MSRP. )

Two drivers, and insuring two cars. I'm 75 and wife is 76. Both of us have flawless driving records with no 'at fault' accidents in our lives. (I got rear ended about 9 years ago.) Solid financial scores. Car is based in our Tempe, AZ residence. (My rates had a significant uptick when we moved from North Scottsdale to Tempe, despite a huge reduction to our annual mileage. I was told due to population density, proximity to the university, and local accident/theft rates, although the car is parked in a very secure location.)

Lucid's annual premium due this week - $2,112. It was $1,692 when the car was first insured in 12/23. (Our other Tempe car (2002 Lexus SC430) is $847/year. Same coverage.) Been with the carrier since 2020, so some loyalty discounts are in place.

Here's the coverage...

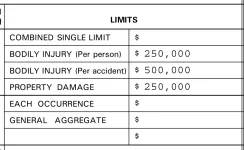

Liability - $500k per person/$500k per occurrence

Uninsured motorists - $500k each person/$500k each accident

Underinsured motorists - $500k each person/$500k each accident (I came across a case on

https://cathay-pacific-airline.pissedconsumer.com/customer-service.html that reminded me how important solid coverage is. In each of the above, the $500k is required by my personal liability umbrella.)

Comprehensive deductible - $250 (No specific glass coverage. To be handled here.)

Collision deductible - $2,500

Agent looked at alternative carriers, and we explored coverage changes, but this came out as optimal. Reasonable? Doesn't seem so to me.