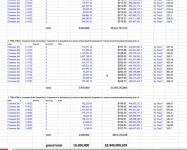

"Amid supply chain constraints and

production delays in China, Tesla reported that it earned a $3.3 billion profit in the first quarter of 2022".

As of October 2022, Tesla, the Texas-based EV automaker, has sold more than 3 million units on a global scale.

"Toyota Motor Corp.'s quarterly profit through September totaled 434 billion yen, or $2.9 billion, down from nearly 627 billion yen a year earlier."

2022 Q1

- Toyota: 450,227 (down 14.9%)

- Lexus: 64,365 (down 13.3%)

- Total: 514,592 (down 14.7%)

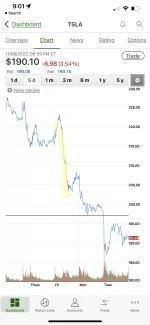

I am not a Musk fan, but Telsa is doing something right.