Jumping in on this discussion:

I have been doing all of the same research everyone here has been doing regarding buying, leasing and financing. What I have come to is that; a lease roughly increases the total amount spent by ~5% when all the lease rent fees are accounted for (not going through the math in this post.) What is the VALUE of what that 5% is buying you?

The primary benefit is it buys you optionality in a rapidly changing market. There are also financial arguments to be made in favor of leasing. Here is an exploration of some of the implications:

Potential low resale value scenarios:

In these scenarios the market price at the end of the lease has dropped beyond the lease residuals. Being able to waive the buyback and walk away (granted with potentially brutal “wear and tear” and mileage overage penalties.) would be financially beneficial and avoid the headache of selling/ trade-in.

- Rapid technological development making Lucids specs not worth the premium

- Significant EV demand reduction (unlikely but still possible w/ increased tariff costs)

- Loosening of tensions w/ China allowing their ridiculously valuable EVs to enter the US market

- Lucid faces significant operational, service, and solvency challenges

- Bad battery degradation

- Gravity turns out to be a 1st gen lemon factory

In these scenarios the market value price is higher than the lease residuals. You now have equity in your vehicle and can keep the car knowing you beat the bean counter actuaries that come up with the money factor projections. Or sell and pocket the difference and shop for the newest tech.

- Lucid is just badass tech and the market values it and they are extremely sought after secondhand vehicles. PLEASE GOD MAKE THIS SO

- Govt randomly adds large incentives to buy used EVs/ made in America EVs

- Market leading battery degradation

- Tech and software upgrade (

I'm exploring all hypotheticals here but who knows they could crack FSD)

I'm exploring all hypotheticals here but who knows they could crack FSD)

If inflation runs hot your lease essentially gets cheaper every month as the value of the dollar declines.

Easy out if you don’t like the experience of owning the car:

If the Gravity is a buggy annoying mess, but not enough to be a lemon, then you can just be done with it after 3 yrs and walk away. No sunk cost fallacy from cash or financing built equity. This is also a MAJOR Double-edged-sword potential negative. The leasing company has you by the absolute balls and the lease can be almost impossible to get out of if the car is horrible or life happens.

Replacement/ Scarcity Hedge:

If a situation develops where EVs become scarce or just get crappier and lower spec to drive down costs; you can buy out your lease knowing you have a well cared for capable vehicle and battery that has experience most of its initial range loss curve. Also if you just get a golden sample w/ no issues you can bank that at the end of lease and buy it out.

Capital Flexibility:

You can invest that money now and put it to work, a 5% return means the lease is free and anything above that is a cherry in top. Same argument applies to financing.

TLDR: The arguments against leasing are well known and have been examined extensively. IMO the potential upsides to leasing are understated. By leasing you are buying yourself optionality and are insulating yourself from, or capitalizing on the negative, or positive, black swan events.

Lucids CEO was just on TV saying they have run rate until Q1 or Q2 2026… thats not a great thing to hear from the company that basically has a monopoly on servicing your vehicle. So many Gravity features are vaporware (AR HUD *cough*) or comming soon

(Carplay, Phone Key, Hands free DDP, Creature mode, Baby mode, Towing mode, Offroad Mode, Entertainment Apps, AI car assistant, The key FOB working, etc). Further there have been NO INDEPENDENT 3rd party range reviews and early customer efficiency results don’t shake out to be that positive (have yet to see anyone achieving what would be needed to hit near 450mi actual range)

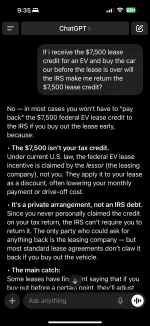

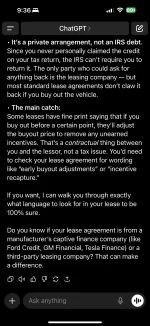

I’m not meaning to FUD, but just trying to show that the $7500 lease cap cost reduction loophole makes the ~5% leasing premium a worthwhile insurance to consider especially given the current headwinds Lucid is facing.

-@David R you are correct that the clawback is contractually obligated, nothing to do with the proposed clawback rule change that got stalled in congress