- Joined

- Aug 17, 2022

- Messages

- 1,807

- Reaction score

- 1,737

- Location

- Harrisburg, PA

- Cars

- Touring ZR/SC/21/SSP/DDP

- Referral Code

- 2BFU7LV3

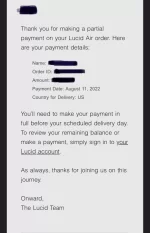

It doesn't need to be in the IRS' code language. The Transition Rule (which allows folks to use the day before the IRA was passed -- August 15, 2022) is codified in law -- meaning it was passed by both the United States House and Senate and signed into law by the President. The IRS follows the tax code which is derived from codified tax laws like the IRA. But to specifically answer your question, I haven't read the IRS' voluminous tax code and this is a new law so it the IRS' tax code likely hasn't been updated to reflect it yet. That doesn't mean it isn't in effect. The IRA was effective as of August 16, 2022.To be clear, I agree with your interpretation. And, I think it's great that you were successful in getting the credit. To clarify my question, are you aware of anywhere the IRS says exactly what Rivian said in their email? "Taxpayers who took delivery in 2023 or after must use August 155, 2022 as the date placed in service..."? Is that actually in writing anywhere other than in Rivian's email? I can't find it anywhere. Again, I'm trying to build my case with my tax guy.