No, I meant what I said. 3-8. 38 shares. I just dipped a toe in. My portfolio is doing wonderful, don’t you worry.Did you mean 38K shares? 38 shares is nothing even at $17 per share cost basis. In the grand scheme of things (I.e you cannot go broke losing ~ $700). Lets be real

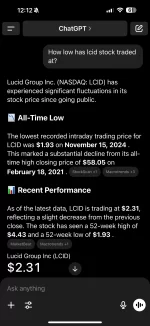

My point is, the stock is a dud. Glad I didn’t invest much.