Asked my SA for MF and residuals. He said they don’t have it but had this sheet for DE and sent me a PDF. Had chat GPT o3 model work through it and it took almost 2 minutes of calculation (kinda long ish time) and came up with the following. 54% residual and 7.3% APR for 36 months and 10k miles on DE. Again we can’t be sure without actual input from Licid but I guess we are in the range. As you can see, financing APR is 6.89%.

-

Lucid Gravity Reservation Tracker: Add Your Gravity Reservation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

LUCID Gravity Lease vs Finance

- Thread starter dhruv

- Start date

I posted this to other lease thread. I calculate 62% residual and 8% APR. I just used the monthly payment formula and two data points from the Lucid website. This assumes that they use the same APR and residual for both points. I did try it with another configuration and different down payments and it came out the same.

I need a lease where I can pay for the whole thing up front and get the residual back when I turn it in... 8% is absurd.

"So it looks like the APR is about 8% and the residual is 62% for 36months 10k miles a year. I ran a bunch of combinations and got the same result.

I ran it for the Air and the interest rate is 3.2% and the residual is 50%."

My Matlab code:

msrp = 122000

net_cap_cost_a = 109115;

monthly_payment_a = 1535;

term = 36;

net_cap_cost_b = 89115;

monthly_payment_b = 913;

residual = sym('residual')

money_factor = sym('money_factor')

x = solve(monthly_payment_a - (net_cap_cost_a-residual)/term - (net_cap_cost_a+residual)*money_factor,...

monthly_payment_b - (net_cap_cost_b-residual)/term - (net_cap_cost_b+residual)*money_factor,...

residual,money_factor)

residual = round(eval(x.residual))

money_factor = eval(x.money_factor)

interest_rate = money_factor*2400

residual_percentage = residual/msrp*100

I need a lease where I can pay for the whole thing up front and get the residual back when I turn it in... 8% is absurd.

"So it looks like the APR is about 8% and the residual is 62% for 36months 10k miles a year. I ran a bunch of combinations and got the same result.

I ran it for the Air and the interest rate is 3.2% and the residual is 50%."

My Matlab code:

msrp = 122000

net_cap_cost_a = 109115;

monthly_payment_a = 1535;

term = 36;

net_cap_cost_b = 89115;

monthly_payment_b = 913;

residual = sym('residual')

money_factor = sym('money_factor')

x = solve(monthly_payment_a - (net_cap_cost_a-residual)/term - (net_cap_cost_a+residual)*money_factor,...

monthly_payment_b - (net_cap_cost_b-residual)/term - (net_cap_cost_b+residual)*money_factor,...

residual,money_factor)

residual = round(eval(x.residual))

money_factor = eval(x.money_factor)

interest_rate = money_factor*2400

residual_percentage = residual/msrp*100

Last edited:

- Joined

- Oct 27, 2024

- Messages

- 1,003

- Reaction score

- 1,476

- Location

- Hunterdon County, New Jersey

- Cars

- 25 Air GT/Gravity ord'rd

- Referral Code

- GZ3PGK37

My SA and I have a lovely relationship. She said “thank you, I will definitely run this up the flagpole.”Don’t think they’d really care tbh.

- Joined

- Sep 19, 2024

- Messages

- 316

- Reaction score

- 618

- Location

- Texas

- Cars

- Gravity Dream Edition

- Gravity DE Number

- 82

I called my sales guy today to AGAIN ask to have the dream edition configurator activated on my account so I could play around with the lease calculator...and instead he sent me the EXACT same numbers in a pdf.... Exact down to the penny (which I assume tonybot must also be in a state with 6.25% car sales tax). At least the numbers are consistent (though bad/spicy).Asked my SA for MF and residuals. He said they don’t have it but had this sheet for DE and sent me a PDF. Had chat GPT o3 model work through it and it took almost 2 minutes of calculation (kinda long ish time) and came up with the following. 54% residual and 7.3% APR for 36 months and 10k miles on DE. Again we can’t be sure without actual input from Licid but I guess we are in the range. As you can see, financing APR is 6.89%.

I called my sales guy today to AGAIN ask to have the dream edition configurator activated on my account so I could play around with the lease calculator...and instead he sent me the EXACT same numbers in a pdf.... Exact down to the penny (which I assume tonybot must also be in a state with 6.25% car sales tax). At least the numbers are consistent (though bad/spicy).

Yep. I am in Texas! I guess my bottom line for leasing rate without actual RV and MF from Lucid. 53-57% RV and 7.3-8% APR. Super spicy indeed and I need to swallow it with a gallon of milk!!

- Joined

- Apr 24, 2022

- Messages

- 779

- Reaction score

- 1,071

Eventually they will start turning knobs. I also suspect the knobs might start turning much faster than any of us realize.Don’t think they’d really care tbh.

They have a 20K goal this year. That isn't going to get hit with Air alone, and based on the responses of many exuberant Lucid enthusiasts on this forum, Gravity won't be enough to fill that gap. Let's see what Q2 and Q3 Gravity numbers look like. Trust me, as an investor I want to be pleasantly surprised. However, I wager we see some nice incentives by Q4, maybe sooner.

I think they need about 6000-7000 Gravity moved between May and end of Dec. Assuming they sell 13000-14000 Airs; essentially matching 2024s delta in units sold from 23-24. They need Gravity to fly off the shelf to hit their 20K target and based on the responses of pretty much everyone here who has been amped for months to get one, I don't see it happening.

On another note, I still think there is a production bottleneck. It took them roughly 3 months to produce 3-4 Gravity for ~35 studios. A whopping 100-140 Gravities plus whatever "press" cars were needed. That's slow as molasses, that's what 1-2 units per day? Then reviewers mention fit and finish problems; not sure if this includes the test drive units being sent to Studios but that means you can't say production was slow because they wanted the units perfect. So even if they have the demand, how are they going to pump out 6000-7000 units? That's an insane jump in units per day.

Or maybe I've been hitting that LSD that's been passed around the last few months.

- Joined

- Sep 19, 2024

- Messages

- 316

- Reaction score

- 618

- Location

- Texas

- Cars

- Gravity Dream Edition

- Gravity DE Number

- 82

I hope they are reading the comments on this forum and reconsidering the lease rates...though I have a feeling the aren't.Yep. I am in Texas! I guess my bottom line for leasing rate without actual RV and MF from Lucid. 53-57% RV and 7.3-8% APR. Super spicy indeed and I need to swallow it with a gallon of milk!!

- Joined

- Jan 4, 2022

- Messages

- 4,306

- Reaction score

- 6,873

- Location

- Santa Clarita, CA

- Cars

- 2026 Gravity Dream

- Gravity DE Number

- 68

- Referral Code

- AWNJLGKT

Well they could get worse. They’re only guaranteeing the Air and Gravity pricing until May while they continue to assess the tariff situation.I hope they are reading the comments on this forum and reconsidering the lease rates...though I have a feeling the aren't.

So once again, they dragged their feet with production and now facing a potential price hike. It’s the Air all over again.

Interesting it seems to be different depending on trim.I ran it for the Air and the interest rate is 3.2% and the residual is 50%.

Tried it with a bunch of Air Pure and got 0.9% and 44% residual.

Touring 3.2% and 50%

GT 5.3% and 54%

Eventually they will start turning knobs. I also suspect the knobs might start turning much faster than any of us realize.

They have a 20K goal this year. That isn't going to get hit with Air alone, and based on the responses of many exuberant Lucid enthusiasts on this forum, Gravity won't be enough to fill that gap. Let's see what Q2 and Q3 Gravity numbers look like. Trust me, as an investor I want to be pleasantly surprised. However, I wager we see some nice incentives by Q4, maybe sooner.

I think they need about 6000-7000 Gravity moved between May and end of Dec. Assuming they sell 13000-14000 Airs; essentially matching 2024s delta in units sold from 23-24. They need Gravity to fly off the shelf to hit their 20K target and based on the responses of pretty much everyone here who has been amped for months to get one, I don't see it happening.

On another note, I still think there is a production bottleneck. It took them roughly 3 months to produce 3-4 Gravity for ~35 studios. A whopping 100-140 Gravities plus whatever "press" cars were needed. That's slow as molasses, that's what 1-2 units per day? Then reviewers mention fit and finish problems; not sure if this includes the test drive units being sent to Studios but that means you can't say production was slow because they wanted the units perfect. So even if they have the demand, how are they going to pump out 6000-7000 units? That's an insane jump in units per day.

Or maybe I've been hitting that LSD that's been passed around the last few months.

I agree with your perspective. I also thought the 450 GDEs would sell out quickly, but I received an email yesterday stating that time is running out to place an order. If the demand is truly high among non-Lucid owners, wouldn't they have already been sold out by now? What does that indicate to us?

- Joined

- Jun 22, 2024

- Messages

- 583

- Reaction score

- 413

- Cars

- 14 CR-V EXL, 24 Air T

So, the question is does it make sense to finance and combine that with some reasonable down payment if your goal is to not pay everything upfront and keep some money working in a yielding account? Or borrow some cheaper money from elsewhere.

- Joined

- Jun 22, 2024

- Messages

- 583

- Reaction score

- 413

- Cars

- 14 CR-V EXL, 24 Air T

I don't think it's well known to non-lucid people what a DE is or it's availability...I agree with your perspective. I also thought the 450 GDEs would sell out quickly, but I received an email yesterday stating that time is running out to place an order. If the demand is truly high among non-Lucid owners, wouldn't they have already been sold out by now? What does that indicate to us?

- Joined

- Jan 4, 2022

- Messages

- 4,306

- Reaction score

- 6,873

- Location

- Santa Clarita, CA

- Cars

- 2026 Gravity Dream

- Gravity DE Number

- 68

- Referral Code

- AWNJLGKT

The point is though that according to Lucid GGT orders have exceeded expectations. They then started offering the GDE to order holders beginning Feb. Now they’ve publicly announced it and said “call your SA to order” it means that all those order holders they went through they couldn’t even get 450 to commit.I don't think it's well known to non-lucid people what a DE is or it's availability...

I've seen a couple of passing mentions to it in the press coverage of the Gravity, but nothing that really explains what it is. And one article stated that the Dream edition would be coming after the Touring was launched. So even press people don't seem to know much about it.I don't think it's well known to non-lucid people what a DE is or it's availability...

- Joined

- Oct 27, 2024

- Messages

- 1,003

- Reaction score

- 1,476

- Location

- Hunterdon County, New Jersey

- Cars

- 25 Air GT/Gravity ord'rd

- Referral Code

- GZ3PGK37

This coupled with the fact that they have now made the referral points the same 4,000 points for all three Airs would seem to indicate that there is a heavy market bias toward the AGT…thus the lower incentives on it which seems to be the opposite of the way things were when I bought in 12/2024!Interesting it seems to be different depending on trim.

Tried it with a bunch of Air Pure and got 0.9% and 44% residual.

Touring 3.2% and 50%

GT 5.3% and 54%

- Joined

- Oct 27, 2024

- Messages

- 1,003

- Reaction score

- 1,476

- Location

- Hunterdon County, New Jersey

- Cars

- 25 Air GT/Gravity ord'rd

- Referral Code

- GZ3PGK37

If the lease deals (on 36 months) were $1700-1800 on GDE and $1400-1500 on the GGT they’d seeing a completely different dynamic (IMHO). Heck, I would have even tried to press my wife to “accept” green with 1000hp over the Ti / 800hp she prefers, but at GDE north of $200 and GGT close to it? Pass…The point is though that according to Lucid GGT orders have exceeded expectations. They then started offering the GDE to order holders beginning Feb. Now they’ve publicly announced it and said “call your SA to order” it means that all those order holders they went through they couldn’t even get 450 to commit.

Interesting it seems to be different depending on trim.

Tried it with a bunch of Air Pure and got 0.9% and 44% residual.

Touring 3.2% and 50%

GT 5.3% and 54%

Interestingly the interest rate and residuals largely cancel each other out to result in similar payments for the customer up front: a low interest lowers the lease payment as does a high residual, and above you get one or the other but not both.This coupled with the fact that they have now made the referral points the same 4,000 points for all three Airs would seem to indicate that there is a heavy market bias toward the AGT…thus the lower incentives on it

The big difference comes at the end of the lease- if the customer were to buy the Air Pure out at lease end they’d do far better than the GT customer. So viewed from a cost to Lucid point of view the Pure is still more heavily subsidized. Perhaps they set residuals to close to where they think they’ll actually be and then set the interest rates to get payments where they need to be to shift target volume? Or they made a corporate decision that they don’t want lower end cars back?

- Joined

- Nov 11, 2024

- Messages

- 653

- Reaction score

- 657

- Cars

- Aviator, Gravity on orde

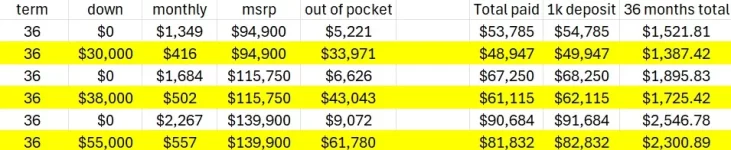

did a little rough Excel math based on the numbers provided by the Lucid calculator and nothing else.

The main theme was this: Take a base GT, 36 months, 10,000 miles and then go 0 down with NYC taxes (8.8865% roughly), then do the same thing with the maximum allowable money down (rounded down to nearest thousand), and then repeat with my config (everything but: base wheels, middle level self driving) and then repeat with Gravity Dream.

The main theme was this: Take a base GT, 36 months, 10,000 miles and then go 0 down with NYC taxes (8.8865% roughly), then do the same thing with the maximum allowable money down (rounded down to nearest thousand), and then repeat with my config (everything but: base wheels, middle level self driving) and then repeat with Gravity Dream.

| term | down | monthly | msrp | out of pocket | Total paid | 1k deposit | 36 months total | |

| 36 | $0 | $1,349 | $94,900 | $5,221 | $53,785 | $54,785 | $1,521.81 | |

| 36 | $30,000 | $416 | $94,900 | $33,971 | $48,947 | $49,947 | $1,387.42 | |

| 36 | $0 | $1,684 | $115,750 | $6,626 | $67,250 | $68,250 | $1,895.83 | |

| 36 | $38,000 | $502 | $115,750 | $43,043 | $61,115 | $62,115 | $1,725.42 | |

| 36 | $0 | $2,267 | $139,900 | $9,072 | $90,684 | $91,684 | $2,546.78 | |

| 36 | $55,000 | $557 | $139,900 | $61,780 | $81,832 | $82,832 | $2,300.89 |

Attachments

- Joined

- Nov 11, 2024

- Messages

- 653

- Reaction score

- 657

- Cars

- Aviator, Gravity on orde

here it is if someone wanted to invest the down payment for 3 years at 4%, not really winning there

| term | down | monthly | msrp | out of pocket | Total paid | 1k deposit | 36 months total | 4% interest |

| 36 | $0 | $1,349 | $94,900 | $5,221 | $53,785 | $54,785 | $1,521.81 | |

| 36 | $30,000 | $416 | $94,900 | $33,971 | $48,947 | $49,947 | $1,387.42 | |

| 36 | $0 | $1,684 | $115,750 | $6,626 | $67,250 | $68,250 | $1,895.83 | |

| 36 | $38,000 | $502 | $115,750 | $43,043 | $61,115 | $62,115 | $1,725.42 | |

| 36 | $0 | $2,267 | $139,900 | $9,072 | $90,684 | $91,684 | $2,546.78 | |

| 36 | $55,000 | $557 | $139,900 | $61,780 | $81,832 | $82,832 | $2,300.89 |

Similar threads

- Replies

- 5

- Views

- 467

- Replies

- 11

- Views

- 968

- Replies

- 6

- Views

- 610