Morning,

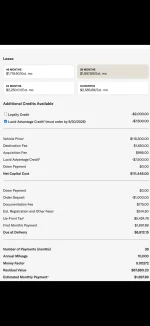

I received a call from my SA yesterday that said my Gravity is ready for pickup after signing the lease paperwork and it took only 10 days to received that call. I signed some papers yesterday and none of them give the financial details on the lease. I suspect I will get it on the day of delivery.

I am mostly excited and also a bit nervous with the posts I have been reading especially about the access via key.

Keep you all posted,

I received a call from my SA yesterday that said my Gravity is ready for pickup after signing the lease paperwork and it took only 10 days to received that call. I signed some papers yesterday and none of them give the financial details on the lease. I suspect I will get it on the day of delivery.

I am mostly excited and also a bit nervous with the posts I have been reading especially about the access via key.

Keep you all posted,