Sid432

Referral Code - X1VWPQ1V

- Joined

- Jun 5, 2022

- Messages

- 439

- Location

- New Jersey

- Cars

- AT | Q5 | MDX | MURANO

- Referral Code

- X1VWPQ1V

Hi guys - trying to understand how to Federal Tax Credit would work?

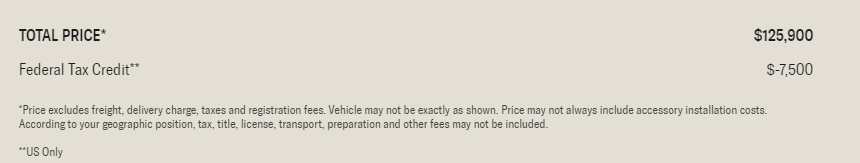

I have already upgraded my Pure reservation to Touring. However, I noticed on the portal, they have the price listed and a deduction of Federal Tax credit of $7500.

For the people who had already received their Air's, was this deducted outright from the price or you would claim it on next year tax filing

Appreciate the clarity and guidance

I have already upgraded my Pure reservation to Touring. However, I noticed on the portal, they have the price listed and a deduction of Federal Tax credit of $7500.

For the people who had already received their Air's, was this deducted outright from the price or you would claim it on next year tax filing

Appreciate the clarity and guidance